Fully independent wealth management firm

Types of mandates

Discretionary management of portfolio sub-managers interacting frequently with the client.

In this situation, the firm takes charge of the documents and other requirements related to “know the client” and “investment suitability” for one, several or all the sub-managers. The firm will manage the sub-managers at its discretion and serve as the point of contact between the client and the sub-managers. Following the firm’s analyses and frequent interactions with the client, it can make changes to the client’s portfolio.

Discretionary management of the portfolio managers ("outsourced CIO")

In this situation, the firm makes investment decisions on a continual basis. The firm manages the client’s assets under full discretionary management, in accordance with the client’s investment objectives and restrictions. The firm is charged with working with the client to determine the client’s asset mix and with making changes to the composition of the client’s portfolio in a fully discretionary manner based on market conditions as well as the economic and political environment.

Investment management consulting

In this situation, the client is responsible for investment decisions and each manager selected by the client retains the responsibility related to “know the client” and the other applicable regulatory requirements. The firm has no discretionary power over the client’s portfolio, and the client is responsible for making the definitive investment decisions.

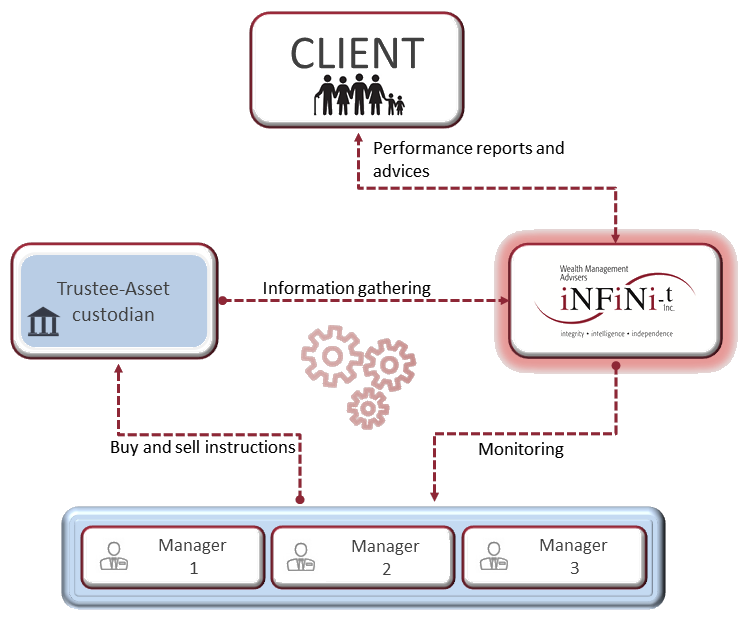

Organizational structure

iNFiNi-t inc. gets involved from the outset, structuring the client’s portfolio, and it stays involved, overseeing and evaluating the selected managers..

The client’s assets are transferred to an asset custodian. The custodian’s main role is to hold the investments on the client’s behalf, ensuring transparency and controlling access to the assets.

Discretionary managers manage the client’s investments on a day-to-day basis and submit buy and sell instructions to the custodian. No funds can leave an account at the custodian without the client’s written consent.

Investment strategy

Implement an investment strategy

- Once objectives and constraints have been identified, a written statement of investment policies and procedures (SIPP) will developed and prepared for each portfolio manager with a segregated mandate, making adjustments as the client’s needs change.

- Investment management structures are analyzed and presented in order to establish an appropriate structure for all the assets.

- We look for and recommend the portfolio managers or investment products required to set up the structure and fulfil the investment requirements defined by the client. For each search, the client receives a shortlist of recommended managers, including a brief profile of each manager and the reasons why it was selected.

- The client receives our advice on selection of a custodian, as well as the administrative support required to move the assets to the new investment structure maintained by the custodian.

- Management fees are negotiated with the portfolio managers.

- We prepare all the account opening documents, asset transfer documents and fund transfers authorized by the client.

Manager selection

Manager search and selection process

- Each year, iNFiNi-t meets with over 100 potential managers, in addition to the 200 meetings held with its clients’ managers. These meetings are an occasion for us to develop a first impression of the new managers, which are then added to the firm’s private database. We are always on the lookout for new opportunities.

- Our committee analyzes the managers using a tried and tested process: regularly filter through a list of managers that meet certain predefined performance and quality standards, draft performance attribution and inter-manager correlation reports, and evaluate the managers’ flexibility, transparency and accessibility.

- Our independence also allows us to work with managers previously selected by our clients and integrate them into our investment strategy.

Performance evaluation

Performance measurement and ongoing monitoring

- Monitor and continuously measure the investment portfolio’s performance against the SIPP accepted by the client. Recommendations are regularly made on asset rebalancing, among the various managers or by asset class, in order to maintain asset classes within the agreed ranges.

- When investments are made in mutual funds, we conduct ongoing due diligence reviews of the fund (transparency, audited financial statements, the external professionals involved, etc.).

- We continuously monitor managers with mandates from our clients.

Multi-family office services

Multi-family office services

- Training for interested family members on the world of investment.

- Providing administrative support to complete the regulatory forms that may be required by third parties and are necessary in investment portfolio management.

- Managing cash, coordinating fund transfers, paying tax instalments and bills authorized by the client.

- Actively assisting the executor settling an estate.

- Planning philanthropic initiatives or assisting in the creation of private family foundations.

- Providing bookkeeping services.

- With the client’s consent, working and sharing information with various stakeholders (accountants, tax specialists, auditors, legal counsel, etc.).

- Archiving managers’ statements of account and invoices or related correspondence.

- Verifying the fees charged by managers and the custodian.

- Private concierge service (private parties, caterer or chef at home, landscaping, etc.).